Dental Implant News: Upfront: Bill Wynn, CEO, on Biomedical Implant

Source: Deborah Nason, www.bizjournal.com

On board since last month, Wynn found the appeal of the dental implant company to be a “no-brainer” for several reasons.

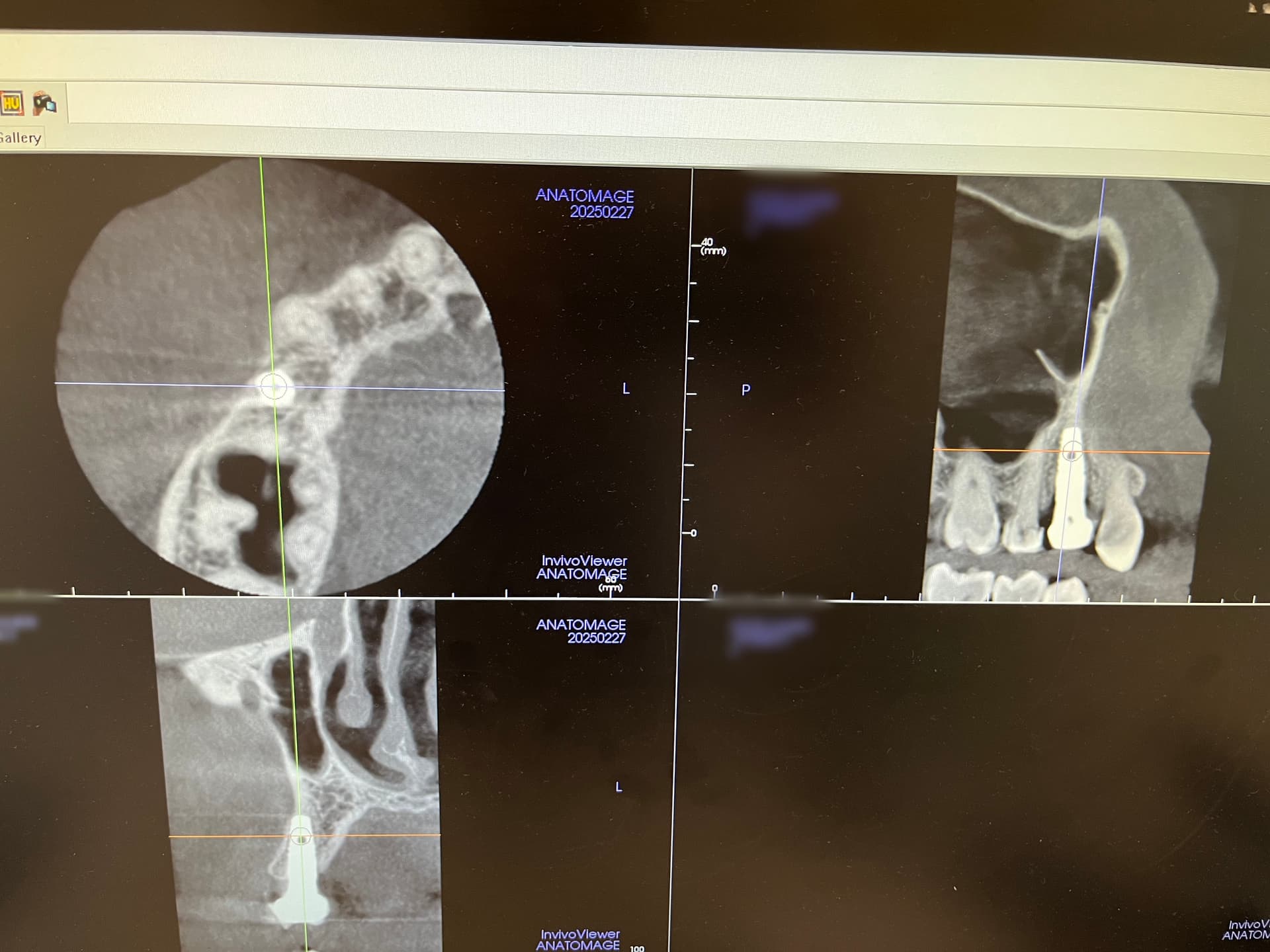

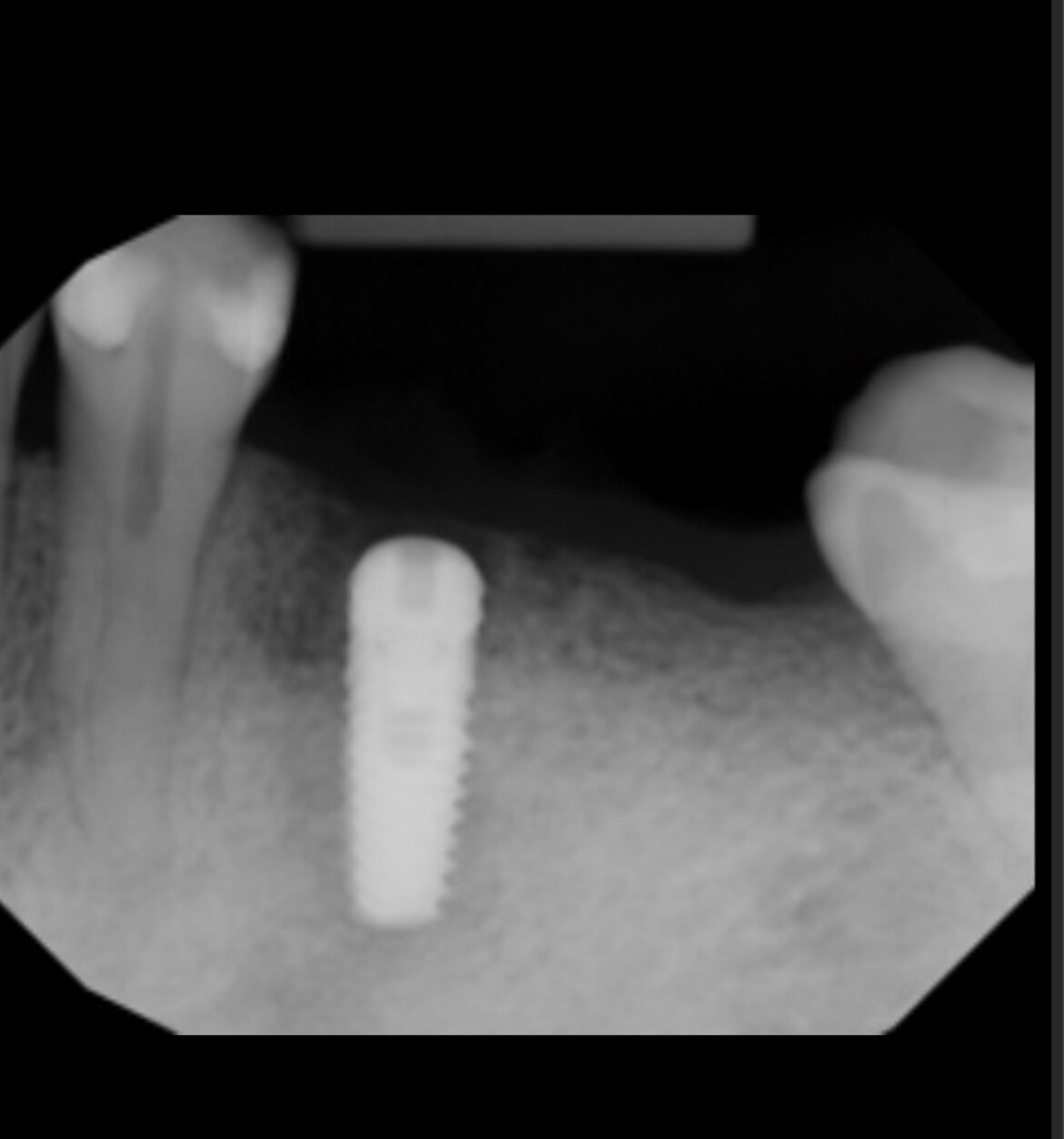

Biomedical Implant´s technology features a universal design that radically simplifies the process of inserting dental implants. Its product catalog contains only five items-instead of the thousands required by implant systems primarily in use today.

On board since last month, Bill Wynn found the appeal of the company to be a “no-brainer” for several reasons. “[The technology] works, it is FDA approved, and only two percent of the market is taken,” he says. The market for dental implants is at $250 million in the U.S., and $1.2 billion worldwide.

Career path: Wynn has had the good fortune of recognizing his passions and strengths early in his career. After working in advertising and retail, he found himself drawn to computers and, eventually, information technology. He rose through the IT ranks like a meteor, consulting on system integration projects for organizations like the Army Corps of Engineers and Citicorp. At age 35, he walked away from it all, deciding “I was born to do my own thing.”

Exploiting his natural talent for building organizations, he founded a technology company in 1994 which he sold in 2000 in a multi-million dollar deal. After puttering around his Potomac, Md. estate for a while, he went back to work, establishing his own hedge fund in 2001; by early 2005, it was up and running.

What brought him to the region? Restless for a new challenge, Wynn visited Blacksburg last September to spend a day reviewing business plans and listening to presentations from companies involved with Carilion Biomedical Institute and VT Knowledge Works. “I came down to give my two cents worth,” he says.

But something else happened. “When the founder of Biomedical Implant was presenting, he hooked me. He had put everything he had into his company, and he [already] has everything he needs-except the marketing know-how and the [necessary] time.”

By the end of the day, Wynn was the new CEO and board chairman, with an equity stake. His 12- to 18-month plan is three-fold: “Structure the company with business and marketing plans, raise $10 to $11 million in capital, hire my replacement.” Advice for the region: Sophisticated, self-assured, well-heeled-angel investors like Wynn are not often seen in this area. “One of the things a region like this needs to do is attract people like me and utilize us,” he says. “[But] don’t try to get me to move,” he says, suggesting that people like him are willing to work part-time and commute long-distance.

Wynn spends four days a week in Blacksburg. He says the area needs “a really nice upscale restaurant-good food is very important to people like us.” Had he ever been to the region before? “Never.”